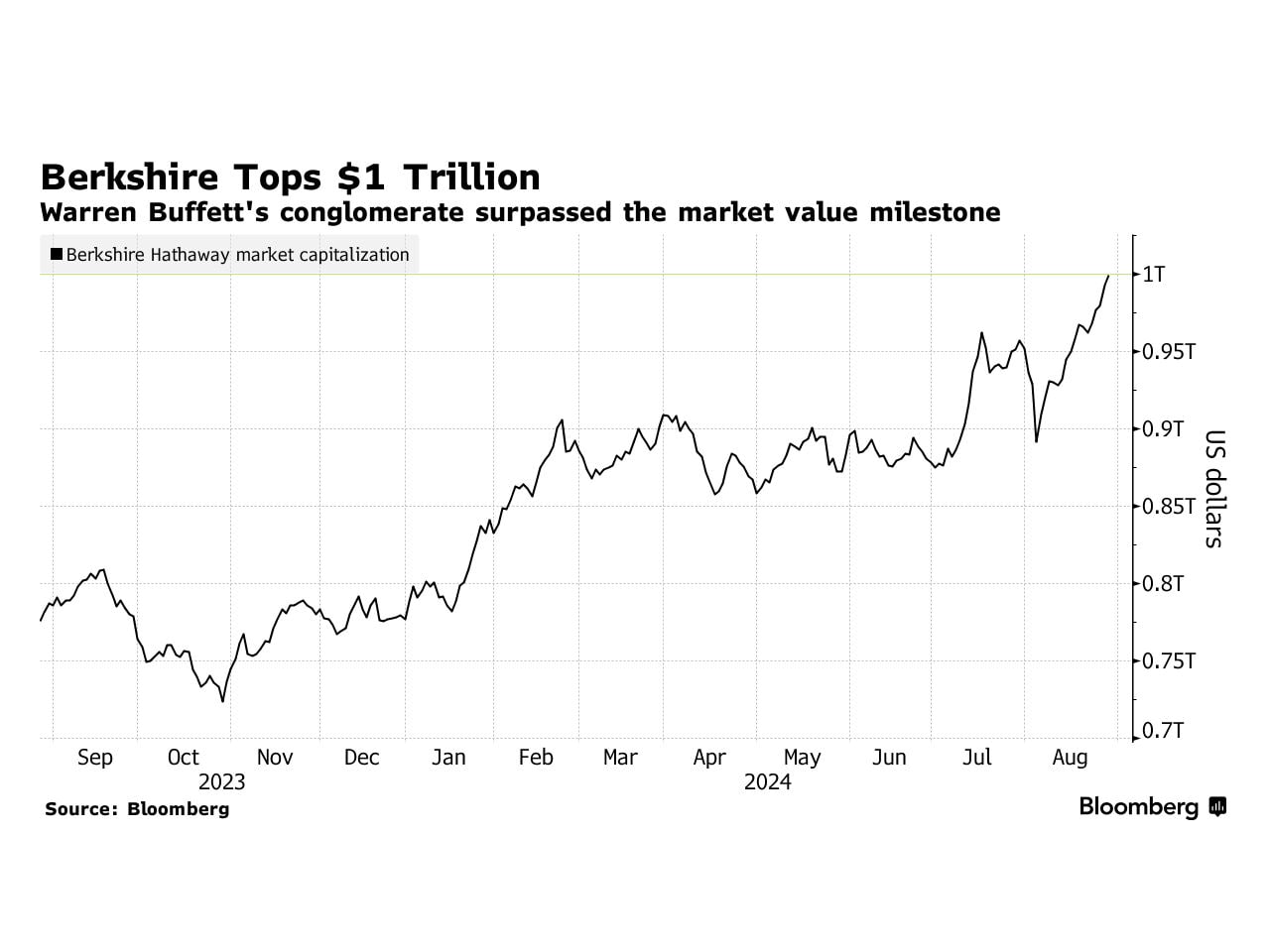

Warren Buffett’s Berkshire Hathaway has become the first non-tech U.S. company to hit a $1 trillion market value, solidifying its place among the world’s financial giants. The milestone comes as Berkshire’s stock continues to outperform the S&P 500, fueled by strong insurance results and a broad economic upswing.

▪️ Historic Achievement: Berkshire Hathaway’s market value surged past $1 trillion for the first time, making it the first non-tech U.S. company to reach this milestone.

▪️ Stock Performance: The stock has gained 30% in 2024, outpacing the S&P 500’s 18% rise, and coming close to the performance of tech’s Magnificent Seven.

▪️ Diverse Portfolio: From Dairy Queen to Duracell, Berkshire’s sprawling business empire reflects its “all-weather” portfolio, giving it resilience in varied economic conditions.

▪️ Strategic Moves: Berkshire has reduced its exposure to Apple Inc. and Bank of America Corp., boosting its cash pile to $276.9 billion, positioning itself for future opportunities.

▪️ Investor Sentiment: Despite its rally, analysts note that the outlook for Berkshire’s core businesses remains stable, with cautious optimism for continued growth.

Homalobby News